Health insurance shouldn't make you sick

Don't leave home without it! But finding the right package at a reasonable price may be the holiest grail of the modern nomad.

If you’re travelling, medical insurance is an important consideration. Many countries won’t even let you in without it. That has created a highly competitive and aggressive marketplace for insurance that, in my experience, is mostly overpriced crap or has online hurdles that make it very hard to actually file a successful claim.

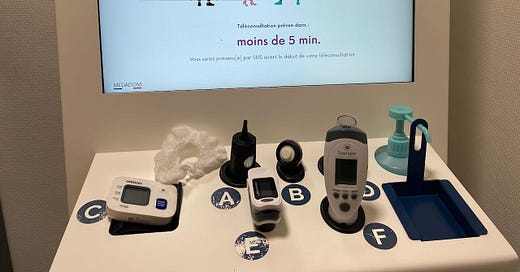

Now, I wasn’t expecting a lot from the insurance I acquired for my nine-month French (Schengen zone) visa. The package cost €285, or about $420, which amounts to $46 a month. It seemed to cover all the important bases, including covid disruption and repatriation of my body in the event I cease using it. It required me to seek pre-approval of any doctor’s visits, which I did in late September, prior to doing a telehealth medical consultation via a remote terminal at a Toulouse pharmacy.

Everything went fine with the doctor once the pharmacist figured out how to input a Canadian postal code into the French system. Seems most countries just use numbers for postal codes, the Canadian mix of letters and numbers wasn’t something the platform was prepared to accept until the pharmacist figured out a workaround. Hats off to kind employee, who undoubtedly spent much more time assisting me than he was used to.

Anyway, the doc, who was in Paris, confirmed my self-diagnosis while I sat in Toulouse. He prescribed meds and gave me an order to get a test at a French lab. I dutifully collected receipts for the doc, meds and test, about $90 CAN, then submitted it to my insurer, Europ Assistance: “You live, we care.”

Yes, seriously. They paid someone to come up with that.

Anyway, after my receipts and papers had been rejected by the bots several times with no explanation of why they were rejected or what else they were looking for, my claim was refused. But for $90, I wasn’t going to lose any sleep over it.

And after reading my policy a little more closely yesterday while fact-checking this column, it may actually turn out to be great news. The policy only covers one “incident” per year. Had I inadvertently been prevented from wasting my entire coverage on a single infection? Did the bureaucrats save my ass? Can I now afford to go out and get really sick or injured? Woo-hoo!

This raises another question about how well those of us who hate to read long legal documents really understand the insurance we buy. Here, I was just trying to get the minimum required for a Schengen visa. And I assumed it worked like health insurance at home, i.e., you use it every time you need it. If it turns out that it’s instead a once-and-done deal, I barely avoided making a potentially huge error that could have blown my nine months of insurance in the first month.

But let’s move onto my next insurance blunder. When I decided to spend up to six weeks in Morocco, I knew my Schengen insurance wouldn’t cover it because, well, Africa is not part of Europe. For some reason, I was convinced something bad was going to happy in Morocco and I wouldn’t be covered. So I did a little online shopping, which triggered one company, Cigna, to start calling me repeatedly to see if I wanted to follow up. But I ignored the repeated calls from Armin, a friendly bloke with Bosnian name and a Scottish accent. After all, what were the chances I’d get seriously ill in such a short time frame? The Moroccan government didn’t require insurance, should I roll the dice and explore North Africa uncovered?

As the date for my flight to Casablanca approached, my jitters took over. Morocco seemed so much farther from home than Toulouse. The French health system is a public one and among the best in the world, the Moroccan system was modernizing, but could I get the care I might need without the backing of a solid insurer? Especially outside the big cities?

I caved about three days before flying and bought a policy that would cost $350 per month, seven times what the Schengen insurance cost. Coverage included everything from semi-private rooms to special consultations, MRIs, CTs, mental health and even dental! It was a Cadillac of coverage, I thought. But if it gave me a sense of security in case I had an accident, if it gave me confidence to go see a doctor of I had any signs of illness, well, it was a small price to pay, wasn’t it?

I’d only been in Casablanca a week when that theory was put to the test. An ear blockage that had been bothering me off and on for a few months was back and I was having trouble hearing out of both ears. So I set out in search of an ear-nose-and-throat doc and sent an email to Cigna asking if they had a Casablanca ENT specialist on their call list. I didn’t have time to wait around tho, I was literally going deaf, so I found one on my own and got an appointment a few hours later.

Turns out that the eczema that’s been bothering me for a few years had built up quite a traffic jam in my ear canal. My right ear was almost completely blocked and the left wasn’t far behind. The doc said he had just the cure, and I watched through a microscope camera as his machine sucked out the crap that had accumulated in my ear canals. I was as good as new! Total cost, about $27, plus another $12 in prescriptions. I dutifully collected receipts and got the doc to write up a report for Cigna.

I was a little shocked the next day when I finally got a response from my insurers. They gave me the list of recommended physicians, but added this footnote: “We would like to note that you do not have coverage for consultation because you do not have the outpatient module purchased on this policy.”

WTF? I wrote Armin right away. “What does this mean, that I ‘don’t have the outpatient module?’ Am I only covered for hospitalization? That seems like an expensive policy for an unlikely hospitalization. I’d like to cancel if that is the case.”

Armin wrote me back to confirm that my health insurance was only good if I end up admitted to hospital. He said it was clear on the policy summary, which includes a line that says “Inpatient/Day Patient $500,000 per year, per person.”

I guess I was supposed to realize that, by mentioning “Inpatient care” on one line in the dozens of pages of documentation, outpatient care was NOT covered. Armin said he mentioned it in our conversations, too, but I know that’s BS. Why would I buy insurance that DIDN’T cover the likely problems but only the unlikely ones? And at seven times the price of my Schengen insurance! I’d have said no in a nanosecond. I’ve been hospitalized only once in my life, I certainly wasn’t expecting a second during a brief visit to Africa.

To cut to the chase, Armin agreed to cancel the insurance, which was still within the 14-day window in which you can change your mind. I also sent a note on the Cigna site, twice, notifying them of the cancellation.

Assuming the problem was now behind me—tho I figured I might have to fight some more to get my $350 refund—I went back to enjoying my now uninsured Moroccan holiday.

It wasn’t until I got back to France last week and was reviewing my credit card statement that I noticed that not only had Cigna not refunded my money, on Dec. 31 they had charged me for another month!

So I fired off more emails to Armin and Cigna’s customer complaint (ICE) division. Armin promised once more to ensure the cancellation was done. ICE ignored their promise to respond within two days and have thus far remained mum.

And I have lost all faith. So I wrote my bank yesterday to ensure no further payments would be processed and to request they recover the unauthorized debits.

⚜ ⚜ ⚜

Insurance is supposed to give you peace of mind, not pick your pockets. In my case, I’m lucky that the two doctor visits I made were relatively cheap, and that both revealed some gaping flaws in the policies I’d purchased.

Anyway, if I have a lesson to share here, it’s this: figure out exactly what insurance you really need before you buy, and maybe consider a broker to help get you the best price. And no matter how busy you are when you get the package, read it like your life depends on it.

It very well may.

Thanks for keeping me company on today’s rant!

Footnote: After my bank intervened, I was given a full refund for the Cigna insurance: $700

I had a typo in the original version, pricing my Signa insurance at $250 a month. It was actually $350, so 7 times as much as my Schengen insurance.